sustainable mobility

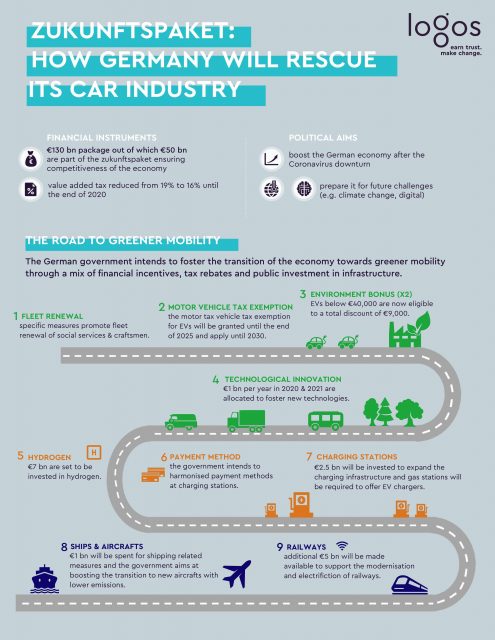

Zukunftspaket: how Germany will rescue its car industry

On the night of 3 to 4 June, the German government agreed on a €130 billion economic rescue package.

It aims at shooting two birds with one stone. First, it will serve to counter the economic decline caused by the Coronavirus crisis. Second, it should prepare the country’s economy and industry for upcoming challenges and structural transitions described in the so-called “Zukunftspaket”.

The package includes both horizontal measures to boost the economy and sector-specific actions to help the industry address upcoming challenges. For example, to spur domestic demand, the government proposed to lower the VAT rates from 19% to 16%, and from 7% to 5% respectively.

EV takeup

Globally, the automotive market has been struck by the pandemic and its lockdown measures that have disrupted supply chains and stalled both production and distribution. Car dealers have been closed for weeks. In April 2020, European passenger car sales dropped by a staggering 78.3% compared to April 2019. Meanwhile, there was a positive outcome. The registration of electric vehicles (EVs) increased by 68.4% in the first quarter of 2020 in Europe. Today, the share of EV registrations rose to 6.8% of the total. In Germany, EV sales increased even further (63.3%) over the same period. Vehicle manufacturers are eager to boost their EV sales. They have to reduce the average emissions of their fleets by 15% in 2025 (from 2021) and by 37.5% in 2030. In case of non-compliance with the EU’s emission reduction targets, companies will be fined. Moreover, from 2021, the EU fleet-wide average emission target fro new cars is set with 95 g CO2/km.

The governments’ decision to disregard diesel and petrol vehicles in the purchase premium mechanism can be seen as a victory of the junior coalition partner and environmentalists.

electrified Germany

At the centre of the discussion regarding mechanisms to support the automotive industry was a purchase bonus. Since the first meeting between the government and the car industry in early May, the introduction of a purchase bonus was a given. Yet, there was some divergence regarding the eligible vehicles. The car industry argued in favour of including the latest diesel and petrol vehicles. Meanwhile, the junior coalition partner (SPD) and environmental organisations emphasised that including conventional cars would put the country’s ecological ambitions at risk.

In February 2020, the European Commission approved the German plan to increase and extend the buyer’s purchase bonus for EVs. Consequently, EVs with a netlist price of less than €40,000 would be eligible for a €6,000 rebate, the cost of which is shared between manufacturers and the government. In addition to this environmental bonus, the German government now suggests doubling its total contribution to €6,000, referred to as an “innovation bonus”, until 31 December 2021. Considering the manufacturer’s deduction of €3,000, consumers opting for an EV below €40,000 are now eligible to a total discount of €9,000. The governments’ decision to disregard diesel and petrol vehicles in the purchase premium mechanism can be seen as a victory of the junior coalition partner and environmentalists. It can also further boost the sales of EVs in Germany.

Last but not least, the motor vehicle tax exemption for EVs will be granted until the end of 2025 and will apply until the end of 2030. It could add momentum to the uptake of EVs in Europe’s biggest vehicle market.

[…] consumers opting for an EV below €40,000 are now eligible to a total discount of €9,000.

charging infrastructure

Until recently, consumers were often sceptical about purchasing an EV. But with falling battery prices and a growing variety of vehicles, EVs have become an appealing alternative. However, a growing fleet of EVs will also require a reliable charging infrastructure, something that the German government also addresses in its “Zukunftpaket”. Berlin promised to invest €2.5 billion to expand the charging infrastructure and foster research and development of electromobility and battery cell production. Last but not least, gas stations in Germany will be required to offer EV chargers.

Practical issues, such as harmonising payment methods at charging stations, are also on the agenda. So far, EV owners typically need to be familiar with a wide range of charging point providers and their applications and payment methods. The government intends to go forward with its Masterplan Charging Infrastructure shortly. The target is to reach 1 million publicly available charging points by 2030.

The rise of the Greens in German and European elections in recent years may have contributed to the final orientation of the government’s plan.

hydrogen

€7 billion are set to be invested in hydrogen. A National Hydrogen Strategy will be published shortly. It aims at positioning Germany as a leading provider of modern hydrogen technology in the world. It will also entail developing a regulatory framework for a hydrogen infrastructure, which should be expanded quickly to boost the uptake of hydrogen-powered Heavy-Duty Vehicles.

2009 vs 2020

After the 2008 financial crisis, a scrappage scheme (Umweltprämie) was introduced in 2009. The German government handed out a conditional rebate for the purchase of a new vehicle (€2,500). Yet, the former vehicle to be scrapped had to be more than nine years old and fulfilled at least emission norm Euro 4. Overall, thanks to an outlay of €5 billion, the government supported the purchase of 2.5 million vehicles.

The current purchase premium is more tailored, and environmental concerns have indeed been taken into account more than ever before. The rise of the Greens in German and European elections in recent years may have contributed to the final orientation of the government’s plan.