transport & mobility

EU trade: key for automotive recovery

Long before the first COVID-19 case came to the public eye; the intricate and multi-trillion-worth web of global trade was already in turbulence.

The so-called US-China “Trade War”, the uncertainties surrounding Brexit and the UK’s future trade relationship with the European Union (EU) were already affecting supply chains. The unprecedented disruption resulting from the current pandemic highlighted more than ever how much the European industry depends on trade. The automotive industry is no exception.

Automotive production, as for many global industries, relies on complex supply chains scattered around the globe. At the same time, machinery and transport equipment exports are of prime importance to the EU economy, accounting for more than €850 billion or 40% of all goods exported from the EU. And while in 2019 the EU exported 5.6 million motor vehicles (worth €136 bn), the latest forecasts provided by the European Automobile Manufacturers’ Association (ACEA) anticipate a record 25% drop in car sales in 2020.

The revitalisation of the automotive industry will prove pivotal in the EU’s economic recovery. In that regard, the enhancement or (at a minimum) the preservation of trade relations with large markets will be critical. Let’s focus on the two predominant ones (China and the US).

The revitalisation of the automotive industry will prove pivotal in the EU’s economic recovery.

EU-China: friends or rivals?

China exports car parts to almost every manufacturer in the world, creating a supply chain dependency which came in the spotlight during the COVID-19 crisis. Even before the pandemic, growing concerns about full reliance on Chinese imports had led to a market trend toward diversification of sourcing materials. QIMA data showed that EU brands began favouring North Africa and the Middle East, with inspection and audit volumes in those regions tripling in 2019 vs 2018. In the COVID-19 coloured context, EU Trade Commissioner Phil Hogan underlined the necessity to ensure supply chain resilience and sustainability, which relies more on industrial than trade policy. Internal market regulations could make a difference in the setup of supply chains by steering the decisions of profit-maximising companies. In the long run, due diligence regulations and regional sourcing could contribute to a more resilient and sustainable supply chain in Europe.

More than 17% of the EU global car export value heads to China.

Meanwhile, the European legislator introduced new trade defence measures to protect and boost the bloc’s manufacturing base. By the end of 2019, the EU had 140 trade defence measures in place, which represents a 5% increase compared to 2018. And these measures predominantly concern imports from China.

More than 17% of the EU global car export value heads to China. What is more, EU-owned automobile manufacturers account for nearly 25% of total Chinese car production. The EU cannot afford to disregard either of those facts when assessing its current and future trade relationship with China.

EU-US: a need for action?

The EU and the US combined comprise the largest automobile market in the world. As anticipated, the Trump administration “America First” policy strained transatlantic trade. In 2018, the US administration raised its tariffs on steel and aluminium imports from the EU. A domino effect in the trade relationship ensued, with the EU retaliating by targeting €2.8 billion-worth of US exports.

the US is the number one destination for EU-built cars

In the end, trade tensions and reallocations have had significant repercussions on the EU economy, the most open market in the world. In May 2019, President Trump announced that an investigation had concluded that auto imports could threaten US national security. Such a statement implied that extra tariffs on EU car imports could occur. In the end, the US President did not follow through with his threat. Yet, it fuelled uncertainty, which altered trade and investment decisions. Eventually, several European carmakers were adversely affected.

Considering that the US is the number one destination for EU-built cars (29% of total export value), mitigation of these transatlantic trade tensions is paramount. Could a change of the US Government alter the current situation? It is unrealistic to expect an easy resolution to a complex and long-standing partnership dispute of this magnitude, especially since American scepticism towards international entanglements preceded the Trump administration. But perhaps a win for the Democrats could manifest into a more predictable global framework. This backdrop would allow the EU to work with Washington on the reform of the World Trade Organization and renew transatlantic trade talks, instead of reacting defensively to a series of erratic and unilateral US actions.

open trade policy will need to be part of any future economic recovery plan

protection or protectionism?

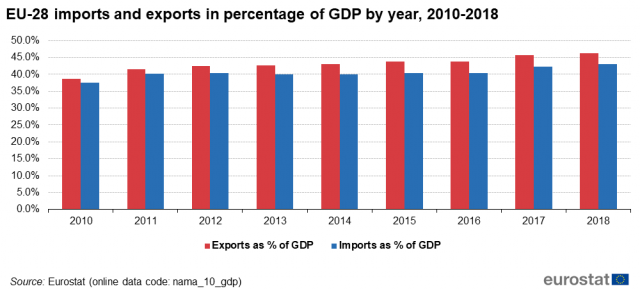

The EU is the world’s largest trading bloc, and external trade has played a dynamic role in boosting its economic growth for many decades. Since 2010 [at least], foreign trade accounts for more than 35% of the bloc’s gross domestic product. Furthermore, as shown by the importance of exports of European industries, trade will remain an essential lever in the EU recovery plan. In the words of the EU Trade Commissioner, “open trade policy will need to be part of any future economic recovery plan.”

Meanwhile, an “open strategic autonomy” was enshrined as a policy priority in the Commission’s May 2020 Recovery Communication. Taking a step towards that direction, the Commission appointed the first Chief Trade Enforcement Officer, Mr Denis Redonnet. A noteworthy part of his role will be to determine how to effectively deploy trade defence instruments to protect EU companies and consumers. In June 2020, the European Commission published a White Paper which launches a discussion on how to address effects caused by foreign subsidies. The White Paper is now open for public consultation until 23 September 2020.

But one cannot help but wonder: is the EU heading towards trade protectionism?

Before answering that question, it is necessary to grasp the difference between protection and protectionism. Yes, the EU is enhancing its trade defence, replicating similar policy tools like other global trade powers such as China, the US, Russia, and Brazil. In parallel, however, the EU is fighting on a worldwide scale to reform and establish a fair multilateral trading system. It has also been advancing on several free trade agreements (Japan, Mercosur, New Zealand, Australia, Vietnam) while striving to forge a new and ambitious partnership with the UK. Thus, the answer is no, not really. The EU seems still adamant on maintaining its free-trade philosophy. But is simultaneously ready to advance its competitive edge in a multilateral but fair framework.

The single market is key to Europe’s prosperity, and it only works well if there is a level playing field.

And while the future is uncertain, one thing remains crystal clear. The automotive industry is crucial to Europe’s prosperity. Its exports generate a trade surplus of €90 billion each year whereas its ecosystem employs more than 14 million Europeans. A strategic recovery plan cannot ignore that.